我從富爸爸身上,學到理財5件最重要的事

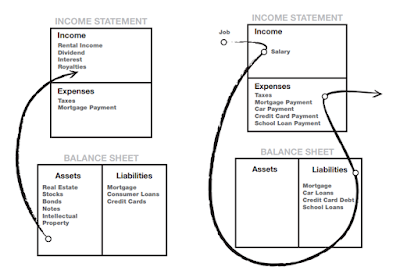

(一)資產VS負債

富人買資產(持續自動放錢入你口袋的東西);

窮人買負債(持續自動偷竊你口袋裡的錢)。

“You must know the

difference between an asset and a liability, and buy assets.”

“An asset puts money

in your pocket. A liability takes money out of your pocket.”

“The rich buy assets.

The poor only have expenses. The middle class buy liabilities they think are

assets.”

(二)現金流

攪清楚:資產給你正現金流;負債給你負現金流。

“Cash flow tells the

story of how a person handles money.”

“Most people don’t

understand why they struggle financially because they don’t understand cash

flow.”

(三)財商

財商為大眾所忽略,縱使是高學歷的人。依我來說,財商是攪懂什麼是資產,什麼是負債,努力實現儲蓄更多的資產,減少負現金流,財商不是太複雜的事。

“A person can be

highly educated, professionally successful, and financially illiterate.”

(四)打工心態(E/S) VS 創業心態(B/I)

(E/S)很多人把打工有收入當成了一種安全感,然後享受消費;

然而最大的安全感是自己成為創業者(B/I),持續買入有價值的東西,成為企業的擁有者(成為股東),把收入轉化為有價值的東西,自己的價值隨企業的價值成長而跟著成長。

“The mistake in

becoming what you study is that too many people forget to mind their own

business. They spend their lives minding someone else’s business and making

that person rich.”

(五) 提早炫耀VS 忍辱負重

羊群心理是一個非常有趣的心理現象,很多人把自己努力活得像富人一樣,然而其實自己力有不及,或在透支著未來,來實現這個目的。富財商者,為了未來更大的價值,而先願意放棄眼前的引誘。複利思想是巴菲特和他搭檔其中一個最喜愛的思想。

“Many financial

problems are caused by trying to keep up with the Joneses.”

沒有留言:

張貼留言